Wouldn’t it be nice to be able to figure out what Bancor is and how it works in 5 mins? Unfortunately with anything new, it takes a little longer. Follow me on my journey of figuring out how Bancor really works.

Lets start with the obvious

I went to their website and found a neat definition.

Bancor Protocol is a standard for a new generation of cryptocurrencies called Smart Tokens

Ok. So it’s a new way to create cryptocurrencies but, what is it really?

It’s like defining a plane as “A mechanism to travel the world and realise your dreams”. Sure but again, what is it really?

A bit further down there’s more meat.

The Bancor protocol enables built-in price discovery and a liquidity mechanism for tokens on smart contract blockchains. These “smart tokens” hold one or more other tokens in reserve and enable any party to instantly purchase or liquidate the smart token in exchange for any of its reserve tokens, directly through the smart token’s contract, at a continuously calculated price, according to a formula which balances buy and sell volumes.

The funny thing is, I actually understand this definition and it’s pretty accurate, but only after spending 3 days reading the equivalent of War and Peace. For those reading this for the first time, let me translate.

Bancor is a factory (Bancor platform) that allows you to make robots (smart contracts) that can automatically buy from or sell to anyone at anytime, any tokens that you invent. These tokens are then backed by another token (reserve token) of your choice.

It has to be backed by another token because this “other” token is how you buy the new token you invented in the first place. And if you want out, you sell your tokens for this reserve token. Let’s look at an example.

Example

Say I wanted to invent a Toastmasters (TM) token (TMT). I create 1 million TMT out of thin air (my supply) and members get 1 TMT for turning up to meetings, 5 for doing a speech, 2 for being the timekeeper and so on (my distribution model).

Let’s say there are only 5,000 TM members world wide. (I know there’s lot more but imagine). This is a very small market. It’s difficult for a non TM to buy a TMT token. They would have to search for, or know a TM, the TM would have to be willing to sell and they’d have to agree on a price. It’s such an arduous process.

If the TMT was listed on an exchange, because there are a low number of participants (5,000 members) and maybe an even lower number buying a selling, this token would be regarded as not very liquid. That is not easily exchangeable and the spread (difference between the buy and sell price) would be large (which is bad).

What I do is choose a token that is more popular (has higher liquidity) with lots of people trading such as bitcoin or ether as my reserve token. So if you want to buy TMT, you use bitcoins or ether and if you want to get rid of your TMT you get back bitcoins or ether. The idea is that it is a lot easier and faster to go TMT -> bitcoin -> fiat cash than it is to go TMT -> fiat cash. (fiat cash = USD for example).

The next question is, what is all this for? What problem does it solve? For this, let’s jump to the whitepaper which is the next convenient link on the website.

The Whitepaper

The whitepaper is very reasonable at 13 page. The key is at the bottom of page 2, “Introducing Smart Tokens: A Solution to the Liquidity Problem“. It’s solving the liquidity problem as we saw in the example above. The last thing a seller wants is to not be able to get rid of a token that is dropping in value and the last thing a buyer wants is not being able to purchase a token that is increasing in value. This robot you created from the factory solves this problem.

By now, you should have a good understanding of what Bancor is and what it does. It’s this “black magic robotic computer android thingee” (aka smart contract) that will buy TMT from you or sell TMT to you whenever you want. The next question is how? That is where page 3 of the whitepaper comes in.

A New Method for Price Discovery

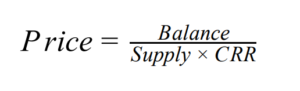

If you are selling to or buying from this robot, how does the robot know the price to sell or buy at? This is governed by the formula below:

The price is the total # of reserve tokens divided by the total # of newly created supply tokens multiplied by a Constant Reserve Ratio (CRR). This is the formula programmed into the robots brain and it will follow this to the letter.

Another way to view this is: Reserve Balance = Price x Supply x CRR. If I buy my TMT from this robot, it will create the TMT token. This increases the supply, the reserve balance increases, and the price increases also.

Ignoring the CRR as it is a constant, essentially if the reserve balance increases, the price multiplied by the supply will have to increase proportionally to keep the equation true. Check the maths and the sample excel calculation for more info.

Is the Bancor model flawed?

According to Professor Emin Gun Sirer and Phil Daian it is. The 29 point analysis is thorough and detailed. What is even more impressive is the response from Eyal Hertzog (a founder). If you read both these links you’ll know where the reference to “War and Peace” comes in.

There are lots of articles around sharing very opinionated thoughts on Bancor such as Thoughts on the Bancor Token Sale and Permissionless Innovation by William Mougayar (a reserved view), A New Paradigm — Understanding The Bancor Protocol by Stefan Pernar (crazy about Bancor) and HitBTC selling Bancor Token (BNT) on IOU – Does this signal the beginning of the end?

The article by Stefan has lots of great practical mathematical examples and even goes so far as seeing a potential Nobel prize!

Shifting gears

Let’s now shift gears and see how much was raised. Bancor raised $153 million. Check out some of the stats here. This link details the terms of the sale. What was interesting was the hidden cap and the minimum time. The minimum time resulted in collecting 150,000 ether ($51 M) more than intended. This meant that the supply was inflated by 58%. Not good.

Summary

Bancor is a neat innovation providing liquidity (the ability to buy or sell not very popular tokens) very easily and quickly based on a smart contract that follows a maths formula. The maths checks out and it seems to have been thoroughly tested.

Some of the negative views of Emin and Phil are valid and the counter arguments from Eyal are also valid. One wonders what if they sat in a room together and had a chat. Most of the issues would probably be ironed out as I see many as a misunderstanding because there is only so much one can infer from a whitepaper.

At the end of the day there has to be respect. Who else can say they’ve raised $153M in an ICO?