There is a growing amount of courses appearing on...

ICO

When you first come across new words and logo’s...

IOTA is a public distributed ledger technology that instead...

I’ll never forget the first whitepaper I read in...

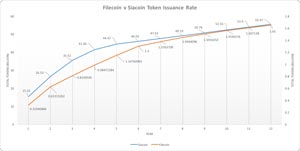

If you have an interest in decentralized storage you...

Storj is developing a next-generation cloud storage solution. They ICO’d...

When you see announcments like Monaco ICO final stats:...

My interest in crypto debit cards comes from the...